💼 Why Delaware is a Global Business Hub

Delaware is one of the most popular states in the U.S. for LLC and corporation formation. Over 65% of Fortune 500 companies are incorporated there. Here’s why:

- 📈 Pro-business tax structure

- 👨⚖️ Dedicated business court (Chancery Court)

- 📜 Flexible corporate laws

- 🌍 Ideal for non-residents and global founders

- 🧾 No sales tax on goods and services in the state

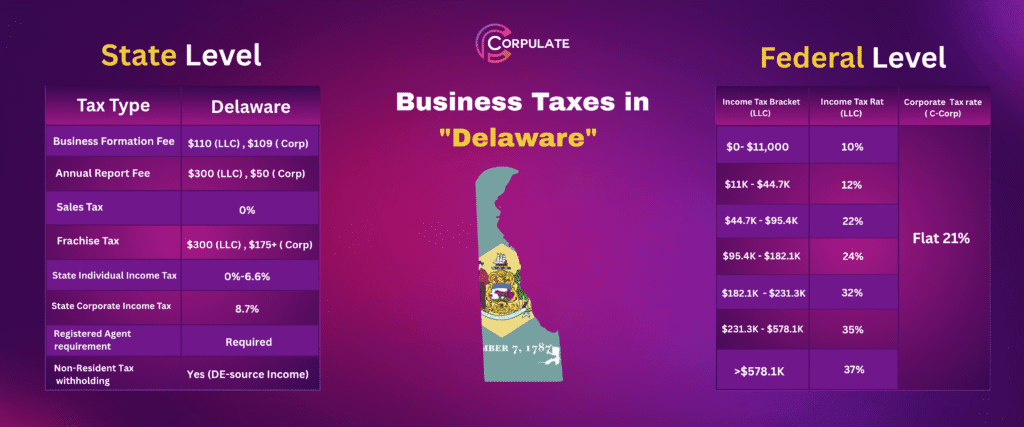

📊 Delaware State Tax Comparison Table (LLC & C‑Corp)

| Tax Type | LLC (Pass-through) | C‑Corp | Notes |

|---|---|---|---|

| State Income Tax | 0% (LLC pays none) | 8.7% (Corporate tax) | LLCs are pass-through; C‑Corps pay state corporate tax |

| Corporate Tax Rate | — | 8.7% | One of the higher state corporate rates |

| Annual Franchise Tax | $300 flat | $175–$200,000 | Based on shares or assumed par value capital for C‑Corps |

| Sales & Use Tax | 0% | 0% | Delaware does not impose a state or local sales tax |

| Annual Report Fee | — | $50 | Required for corporations (LLCs only pay franchise tax) |

Sources: delaware.gov, corp.delaware.gov, investopedia.com, bench.co

🧾 Federal Tax Requirements (Same Nationwide)

| Tax Type | LLC (Pass-through) | C‑Corp |

|---|---|---|

| Federal Income Tax | 10–37% (Individual tax brackets) | Flat 21% |

| Self-Employment Tax | Applies (~15.3%) | Not applicable |

| IRS Filing | Form 1065 + K-1 | Form 1120 |

These apply regardless of the state your business is formed in.

📌 Pros & Cons of Forming in Delaware

✅ Advantages:

- No sales tax at all – makes it easier to operate remotely

- Great for raising capital or attracting investors

- High level of legal protection via the Chancery Court

- Well-established reputation for business credibility

⚠️ Considerations:

- High C‑Corp franchise tax if shares are not structured wisely

- Out-of-state businesses may require a foreign qualification in your home state

- A registered agent in Delaware is required

🤝 How Corpulate Helps You with Delaware Compliance

Whether you’re a U.S. resident or international founder, Corpulate ensures a smooth and compliant experience:

🛠️ Our Delaware Services Include:

- LLC or C‑Corp Formation: We’ll structure your shares & bylaws optimally

- Franchise Tax Handling: We calculate and file your Delaware franchise tax

- Registered Agent Service: We provide a Delaware-based address & agent

- IRS Compliance: From EIN setup to federal returns (1065 or 1120)

- No-Sales-Tax Advisory: Perfect for remote/digital-first companies

- Ongoing Support: Annual reports, compliance alerts, and tax filing reminders

🌟 Who Should Consider Delaware?

- SaaS Startups & Tech Founders

- Investment-heavy corporations

- Global entrepreneurs looking for investor-friendly jurisdictions

- Non-residents who want to scale in the U.S. with credibility

🚀 Ready to Launch in Delaware?

Delaware is a prestige state for business incorporation, especially for C‑Corps planning to grow fast and raise funding. But even LLCs benefit from privacy and no sales tax.

👉 Let Corpulate handle the backend—from formation to taxes.

📲 Visit Corpulate.com to get started today.